Management Accounts

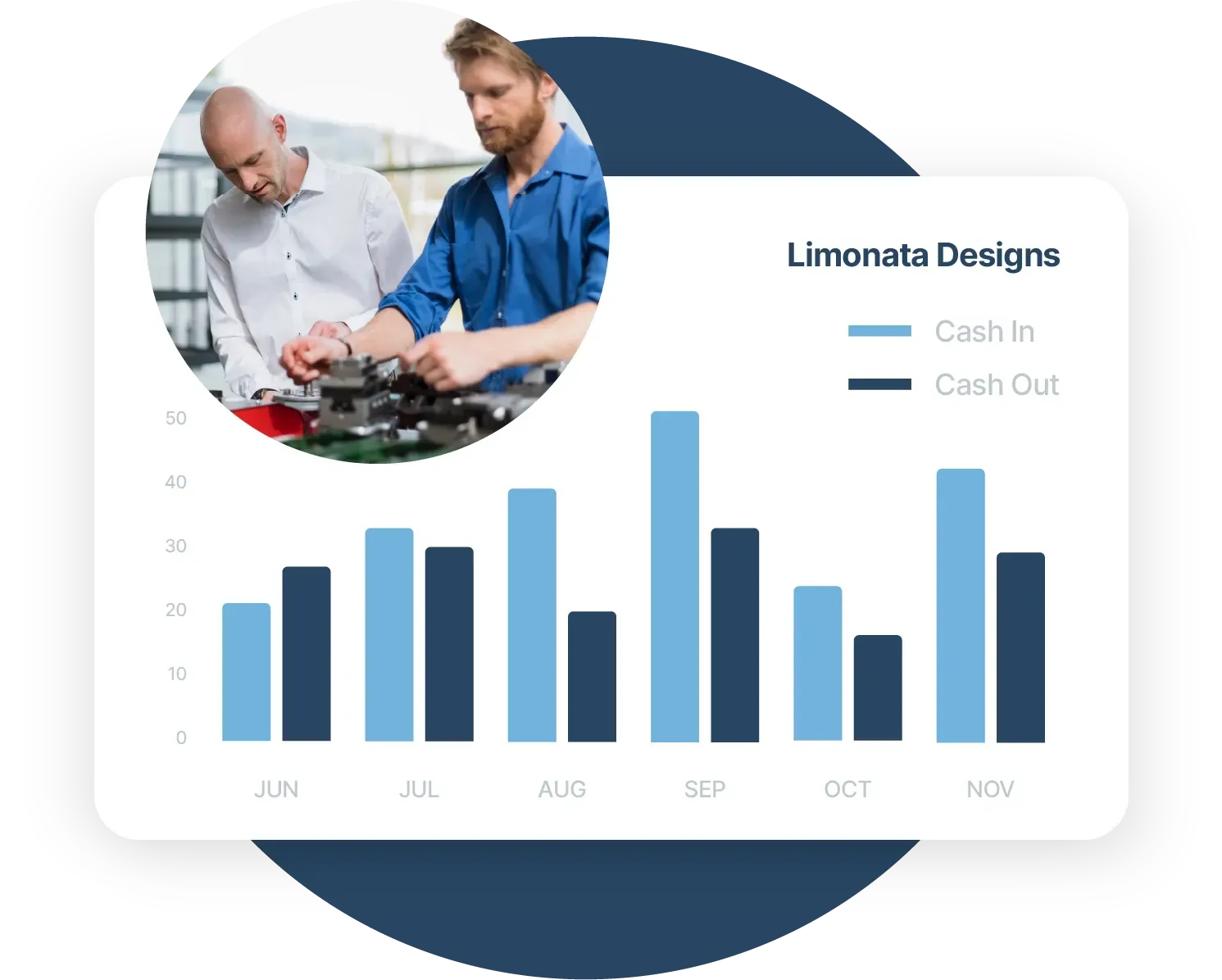

Do you know how much money is coming in and going out of your business on a day by day, week by week basis?

In order that you can make informed decisions to manage your business better, here at Inglis Chartered Accountants we offer a management accounts service that will help you keep on track of your company's numbers.

We'll explain to you what's happening with your cash flow, payables, receivables profit and loss, margins and much much more. You won't have to worry about not knowing where the money is going to or where it is coming from next.

With our management accounts service, we'll take care of all your accountancy needs for you from our York accountants offices. This will range from setting up budgets to reconciling transactions. It will then be easy for you to see what's happening with your finances - and you will be able to keep on track.

Give us a call today on 01904 787973 and we'll get to work straight away!

What's included

Our management accounts and information services include:

Monthly or quarterly management accounts

Reporting of key performance indicators that are the underlying drivers that run your business

Help with in house systems for you to produce your own information

Training on how to get the most out of your information

Supplying management information to lenders

Branch/Divisional results

Actual performance compared to budget and/or comparative periods

Management Accounts Services FAQs

-

What are management accounts?

Management accounts are internal financial reports produced regularly (monthly or quarterly) to provide insight into the performance of your business. They typically include profit and loss accounts, balance sheets, cash flows, and variance analysis to help you make informed business decisions.

-

Why are management accounts important?

They are essential for tracking your business's financial health, identifying trends, managing cash flow, and making strategic decisions. By analysing these accounts, you can spot opportunities for improvement and address issues before they become significant problems.

-

What is the difference between management accounts and financial accounts?

Management accounts are used internally for decision-making and are not necessarily prepared in accordance with statutory requirements. In contrast, financial accounts (or statutory accounts) are prepared annually, following strict accounting standards, primarily for external stakeholders like investors, banks, and tax authorities.

-

How often should I review management accounts?

It's best practice to review them monthly or quarterly. This frequency helps you keep a close eye on your business's performance and make timely adjustments to your strategies.

-

What should I look for in my management accounts?

Focus on key performance indicators (KPIs) relevant to your business, such as revenue growth, profit margins, cash flow, and inventory turnover. Also, pay attention to budget variances to understand where you're over or underperforming.

-

Can management accounts help in budgeting and forecasting?

Absolutely! By analysing past performance and identifying trends, management accounts are invaluable for accurate budgeting and forecasting. They allow you to set realistic financial goals and plan for future investments or expenses.

-

Do I need an accountant to prepare management accounts?

While it's possible to prepare them yourself with the right software and knowledge, an accountant can add value by ensuring accuracy, providing insights, and advising on financial strategy based on their expertise.

Book a Discovery Call

If you’d like to improve your company’s financial performance, or don’t feel you’re getting enough support from your current accountant, book your free discovery call with us today.

Contact

3 Westfield House

Millfield Lane

Nether Poppleton

York

YO26 6GA

01904 787 973

Inglis Chartered Accountants is rated 5 out of 5 based on 43 Google reviews.

© 2025 Inglis Chartered Accountants Privacy Policy Client Login Design by Noir